Golden Nugget Online

Golden Nugget Online 5,0/5 2995 votes

- Borgata Online

- Golden Nugget Online Gaming News

- Golden Nugget Online Gaming Stock Price

- Golden Nugget Online Gaming Earnings

- Golden Nugget Online Slots Real Money

Tilman Fertitta, the billionaire owner of the NBA’s Houston Rockets and fresh off taking Golden Nugget Online Gaming (NASDAQ:GNOG) and GNOG stock public, is back with an even bigger deal.

Golden Nugget Online Gaming (Nasdaq: GNOG) has received authorization from the Michigan Gaming Control Board (MGCB) to start offering its Online Casino and Sportsbook at 12pm Eastern, Friday. Golden Nugget Online Sportsbook. Available on desktop, mobile and tablet devices across the state of New Jersey, The Sportsbook offers great odds and a huge variety of markets across the United States and International sports. Pre-match and live betting (in-game) are available across more than 14 sports. The Online Sportsbook has several unique features including Golden Lines (daily odds boost), Parlay Boost and Match Tracker (a live in-game betting innovation).

© Provided by InvestorPlace a woman smiling while using a slot machine in a casino. representing gambling stocksOn February 1, Fertitta Entertainment announced that it would merge with FAST Acquisition (NYSE:FST), a special purpose acquisition company (SPAC), in a deal valued at $6.6 billion.

Before I get into the whole question about which stock is the better buy, I thought I’d first consider the people behind FST stock. When evaluating SPACs, it’s important to believe in the sponsors and management behind an M&A search.

Popular Searches

Borgata Online

It’s critical, in fact.

Who Is FAST Acquisition?

FAST sold 20 million share units to investors in August 2020.

FST planned to focus its search on the restaurant and hospitality industry. Included in this search would be companies that are related in some way to restaurant and hospitality companies. It comes as no surprise then, that the main people involved with FAST have extensive backgrounds in these industries.

Co-CEO Doug Jacob’s relationship with restaurants heated up in 2013 when he partnered with award-winning chefs Ken Oringer and Jamie Bissonette to grow the Toro restaurant brand to several global cities outside its Boston base. Jacob left that gig in 2016. He also co-founded a full-service creative agency in 2014. Serving as Chief Creative Officer, he served in this capacity until mid-2018, when he founded &vest, an investment firm focused on restaurants and hospitality.

The other co-CEO, Sandy Beall, is a partner in &vest. He’s also the founder of Ruby Tuesday restaurants and Blackberry Farm, one of America’s finest resort properties. Beall sold Ruby Tuesday in 1982 for $15 million in stock and cash. Beall left the company in June 2012. Ruby Tuesdays filed for bankruptcy protection in October 2020.

So it’s clear that this group has a good feel for the type of business they would like to combine with. That’s helpful.

What’s Fertitta Bringing to the Table?

As its press release states, Fertitta Entertainment is putting five Golden Nugget casinos, its controlling stake in GNOG and more than 500 restaurants under the Landry’s, Del Frisco’s, Morton’s, Bubba Gump Shrimp Co. and several others.

That’s a lot of assets.

Valued at 9.3 times its 2022 pro forma adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) of $648 million, the enterprise will have approximately $1.4 billion in cash — $200 million from FAST and $1.2 million from private investment in public equity (PIPE) at $10 per share — which it intends to use to grow the business and pay down debt.

According to its regulatory documents, those last three words are important because Fertitta Entertainment will have $4.6 billion in debt once the combination is completed. Even if it uses 75% of the $1.4 billion raised from investors and FAST, its business will still be highly leveraged.

You’ll also notice that it lists pro forma revenue of $3.4 billion — $962 million for Golden Nugget and $2.5 billion for Landry’s and other restaurants — is for 2019. While Fertitta does not indicate how bad 2020 was, he does say that Fertitta Entertainment should earn $575 million in 2021 and $648 million in 2022.

Most importantly, Fertitta Entertainment likes to boast that it is led by a seasoned management team including Tilman Fertitta, the iconic founder and Chief Executive Officer.

Should You Buy GNOG Stock or FAST?

However, I’ll be honest. I see Tilman Fertitta’s latest move as a way to cash in on the frothy markets we’re experiencing — think GameStop (NYSE:GME) — while getting his hospitality businesses out from under the debt burden he’s facing.

In September 2020, I spoke rather negatively about his SPAC merger to take Golden Nugget’s online operations public.

“Fertitta, who is said to be worth $5.8 billion, is the poster child of the low-interest rate era that we find ourselves. He’s used debt to build his restaurants, hotels, and sports teams (he owns the Houston Rockets),” I wrote at the time.

“In April, Fertitta’s Golden Nugget sold $250 million in debt at 15% interest to keep his empire afloat. Fansided published an article in March that questioned the billionaire’s financial wherewithal to buy the Houston Rockets in September 2017.”

Now, he wants investors to ride to the rescue while maintaining total control of his empire through a dual-class share structure and a 60% economic interest.

If it were up to me, I wouldn’t own GNOG or FST.

However, for those who think it might make sense to buy FST to benefit from its 50% stake in GNOG while also profiting from a rebound at Golden Nugget’s land-based casinos and various restaurant chains, I’d think again.

The debt’s too darn high. If interest rates rise, Fertitta is toast. If you have to buy one of these, I’d go with GNOG.

On the date of publication, Will Ashworth did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Will Ashworth has written about investments full-time since 2008. Publications where he’s appeared include InvestorPlace, The Motley Fool Canada, Investopedia, Kiplinger, and several others in both the U.S. and Canada. He particularly enjoys creating model portfolios that stand the test of time. He lives in Halifax, Nova Scotia. At the time of this writing Will Ashworth did not hold a position in any of the aforementioned securities.

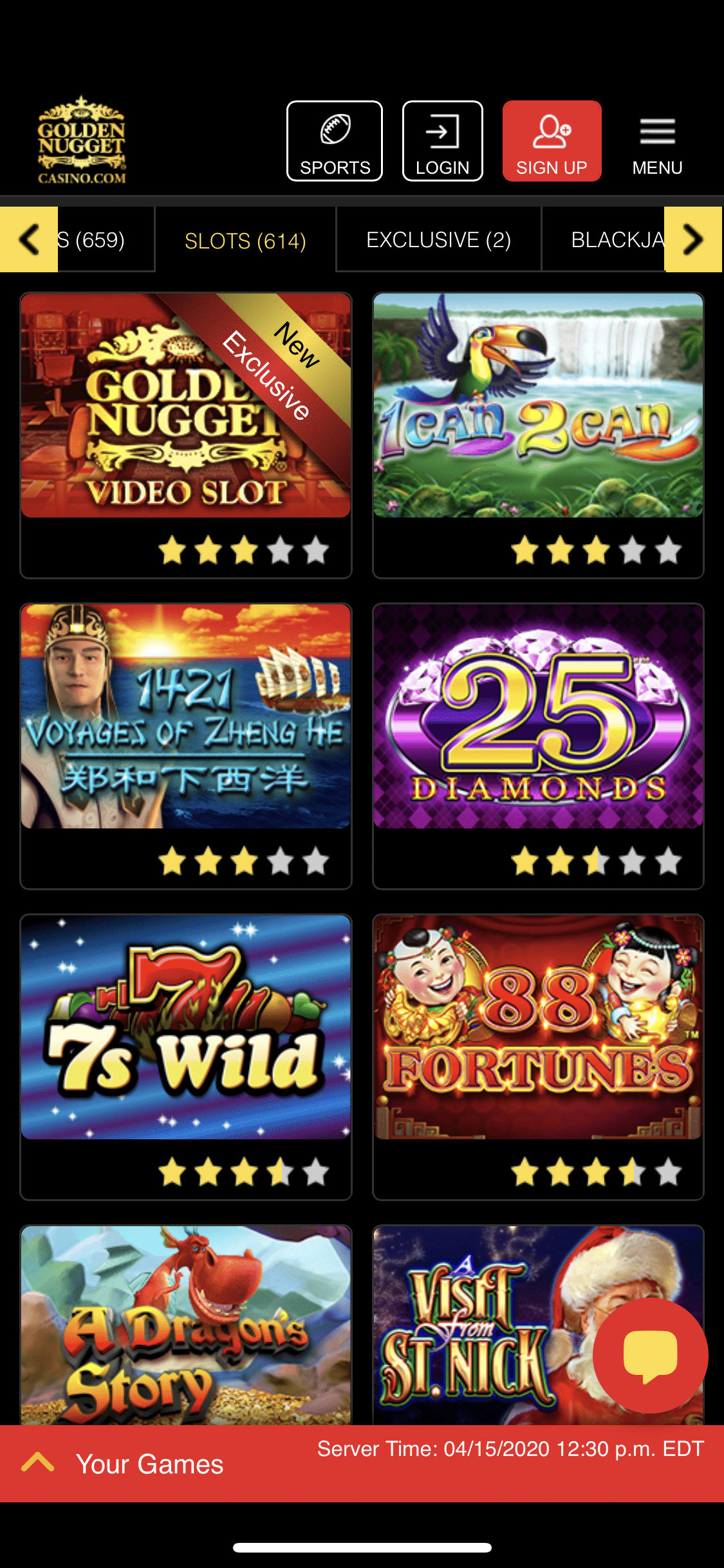

All your favorite games are now available on desktop, mobile and tablet devices, from Divine Fortune to Black Diamond, come play at New Jersey's winner of 'Casino Operator of the Year' for the past 4 years.

Choose from over 700 games plus our exciting LIVE DEALERS with the best customer service team located in Atlantic City.

New promotions and special offers are posted weekly. Play now and get up to a $1,000 deposit match. (Terms and Conditions apply)

Golden Nugget Online Gaming News

What are you waiting for?

Golden Nugget Online Sportsbook

Available on desktop, mobile and tablet devices across the state of New Jersey, The Sportsbook offers great odds and a huge variety of markets across the United States and International sports. Pre-match and live betting (in-game) are available across more than 14 sports.

Golden Nugget Online Gaming Stock Price

The Online Sportsbook has several unique features including Golden Lines (daily odds boost), Parlay Boost and Match Tracker (a live in-game betting innovation).

Golden Nugget Online Casino players may use their casino winnings to bet on sports for a seamless user experience.

Play now and you are eligible for a $100 Risk Free Bet on your first settled bet.

(Terms and Conditions apply)

Golden Nugget Online Gaming Earnings

Get your game on!